Do you always buy when the price is rising to the top and then the price just start dropping non-stop just after you bought? You may need to usd RSI to identify when is too expensive to buy or when is too cheap to sell.

RSI(Relative Strength Index) is an indicator developed by a famous technical analyst J. Welles Wilder, which can help to evaluate the strength of the market.

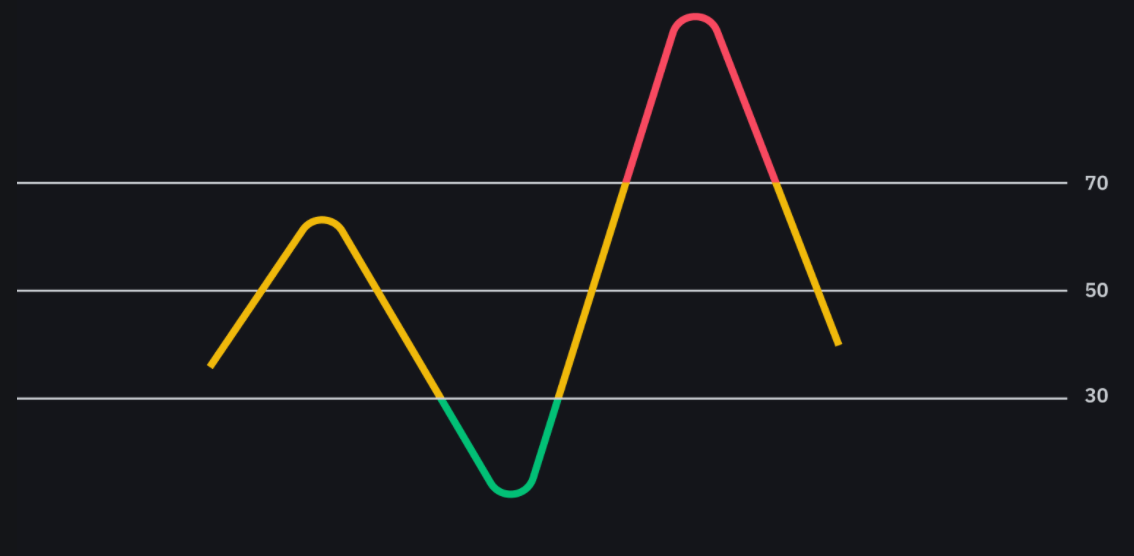

It ranges from 0-100, normally below 30 is considered oversold, above 70 is considered overbought.

Lets skip the formula and jump to application which you probably care about the most

- For Stable Market

Stable market refers to a market where the price bounce up and down between a small range, and does not have an obvious trend.

Buy at oversold, sell at overbought, easy as that. For cryptocurrency, you may consider to set the oversold at 20, overbought at 80, as there is typically more volatility. In addition, you may trade the most traded cryptocurrency (you may consider the top 10 in your crypto exchange) which are typically more stable.

- For Trending Market

Trending market refers to a market where the price goes strongly to one direction, and there is an obvious trend.

Adjust oversold and overbought market according to the trend. For example, if the uptrend is very strong, then the RSI is very likely to stay high, you may consider move oversold up to 40, and overbought up to 90 to decide where to buy and sell. In the case of strong downtrend, you may do the opposite: move oversold to 10, overbought to 60

- For Reversing Market

Reversing market refers to a market where the trend is changing to the opposite of the previous one.(e.g.If it was falling, now it is reversing to rising.)

You may identify reversing market in advance with RSI from the divergence. During a trending market, if you notice the price is continuing going high while the RSI is starting to go low, it may indicate a reverse of the market. The reason behind this is that RSI is showing the willingness to buy, therefore it is supposed to rise when price rise, if it falls it means the willingness to buy is falling and the buying power is not enough to support the price at high level, so it is likely to fall later.

You may also check how to do fundamental analysis and manage risk to increase your success rate.