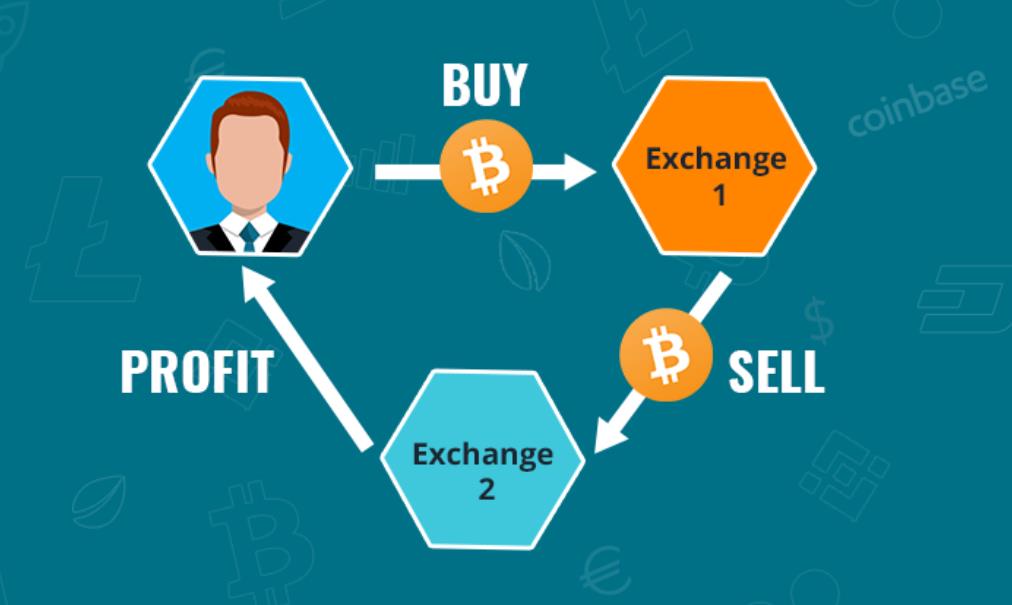

However, in real life, there are more difficulties to really get the profit like that, the common reasons could be the following:

- High Transaction Fee

Crypto exchange normally charges about 0.1%-0.3% fee per transaction, to buy and sell incurs twice the transaction fee, the arbitrage for expected profit below 0.5% may be risky concerning the high transaction fee.

- Withdraw Time

Some exchange may require manual approval for large sum of fund which can take even days, make sure to read carefully about the terms regarding this. In addition, due to the nature of proof of work, coins like Bitcoin may take even hours to transfer to another exchange during peak time

- Market Liquidity

Some crypto exchanges are lack of liquidity therefore you may end up losing money as what you bought from one exchange cannot be sold at the price expected. For example, if you buy 100 ETH at $300 in exchange A, and then you want to sell at exchange B at $303.However,exchange B do not have many traders, only 10 ETH can be sold to them at $303 while the rest of the traders want to buy below 300, then you are in trouble and get a loss

- Market Volatile

Because of the high volatile in cryptocurrency market, the price you see now may change in 1 sec.

you may buy 1 ETH at exchange A at $300 coz you see it sells $303 in exchange B, and when you sell at exchange B you realize it is too late the price bounce back down to $297 and keep dropping.

How to solve this problem? Here are some tips:

- Trade in Crypto Exchange of Low Fee

Binance could be one of the best choice, as the transaction fee is only 0.1%, and it is one of the largest crypto exchange. Click here to register your account and you can get 10% off your transaction fee

- Borrow from the Exchange

This is a way to avoid delay and waiting of crypto transfer from one exchange to the other, it can also save you gas fee to withdraw from cryptos,simple and effective.Below is an example:

Step 1 You put $10,000 in exchange A and $10,000 in exchange B

Step 2 You notice ETH sells at $300 in exchange A and $303 in exchange B

Step 3 You buy 10 ETH in exchange A, and instantly borrow 10 ETH from exchange B and sell at $303 each.

Step 4 You transfer 10 ETH that you bought from exchange A to exchange B, and pay back exchange B 10 ETH

Step 5 Get the profit of $3

Please be noted that above example ignore the transaction fee and leverage fee, you may add these into consideration in practice. The above example is used for a general understanding of how it works

- Choose Market with High Liquidity

You may consider the most popular crypto exchanges, such as Binance, Huobi, Bitfinex, Kraken, OKEx. They are the most traded and reliable exchanges.

- Automate the Arbitrage

As crypto market is on 24/7, and there are so many pairs and market to watch for arbitrage, the price is changing rapidly, it is almost impossible to do the arbitrage without some technology. If you are a programmer, then congratulation, you can automate the process by programming an app. But if you are not, do not be sad, there are alternative solutions. You may consider using a crypto bot to automate the arbitrage, Haasonline is one of the best platform that provide such a bot, not just using inter-exchange arbitrage but also other smart tricks, make sure to check it out!

You may also check out how to use fundamental analysis and technical analysis to increase your win rate.