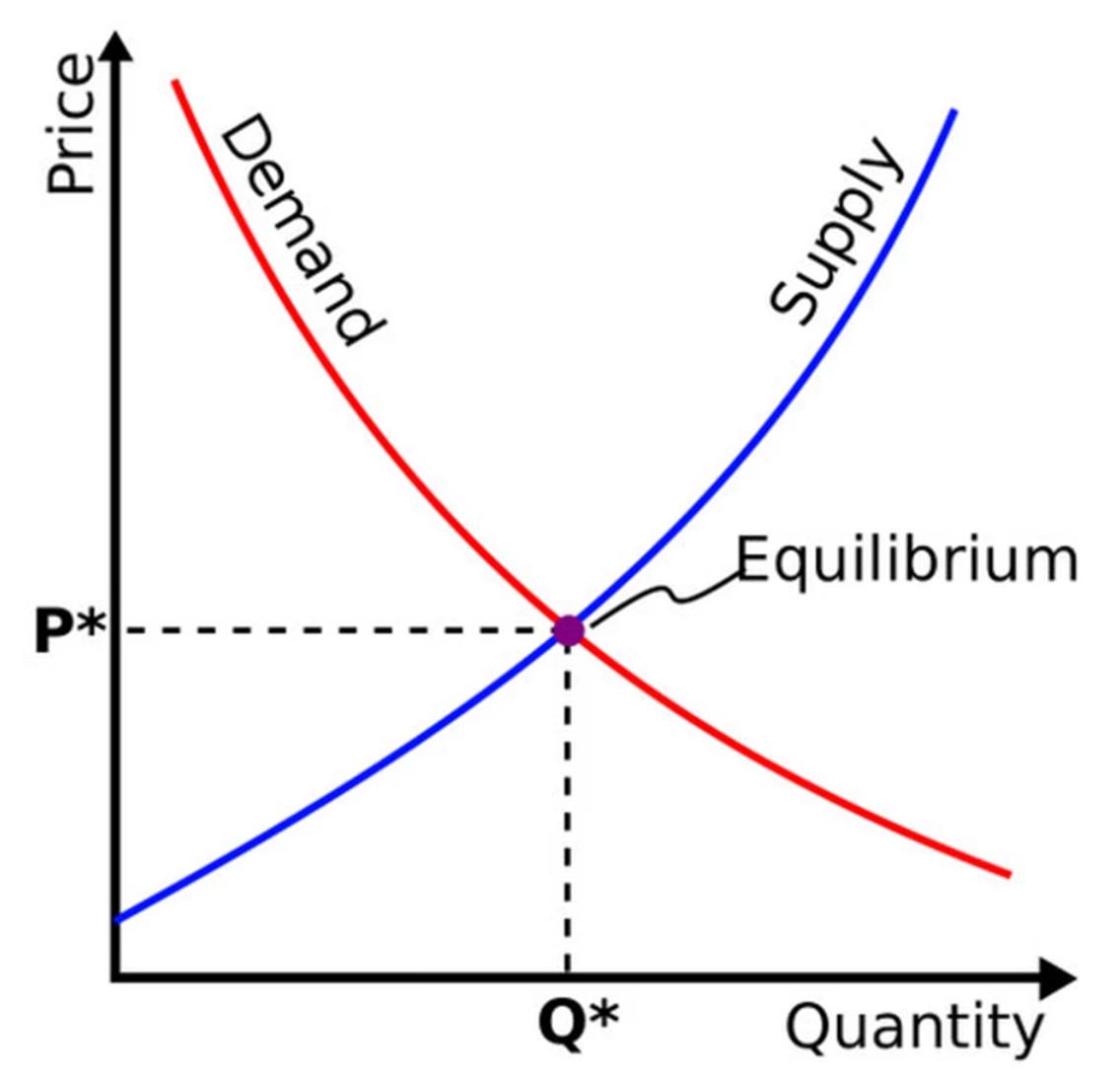

For example, when apples sell at $10 each, there are 100 sellers in the town agree to sell, however only 1 people agree to buy. Therefore the sellers find it hard to sell and lower the price to $1 each, then only 1 sellers agree on this price, however there are 100 buyers want at this price. As buyers want it and demand cannot be satisfied, then maybe eventually 10 buyers agree to buy at $3 each and if 10 sellers agree on this price, the price reach to equilibrium, and likely to always stay close to this price, until the demand or supply change significantly.

If you analyse the crypto price with supply and demand, then you can say that for all the cryptos, if the price increase, it is because the demand for the crypto is increaseing, or the supply for the crypto is decreasing.

Here comes to the answer why Bitcoin becomes a legend in cryptocurrency. Bitcoin has a fixed total amount, and you can get Bitcoin from mining or purchasing. New Bitcoin comes from mining. As Bitcoin has a halving event every 4 years, which will cut mining reward to half. In short, it means every 4 years the increasing amount of supply is decreasing significantly

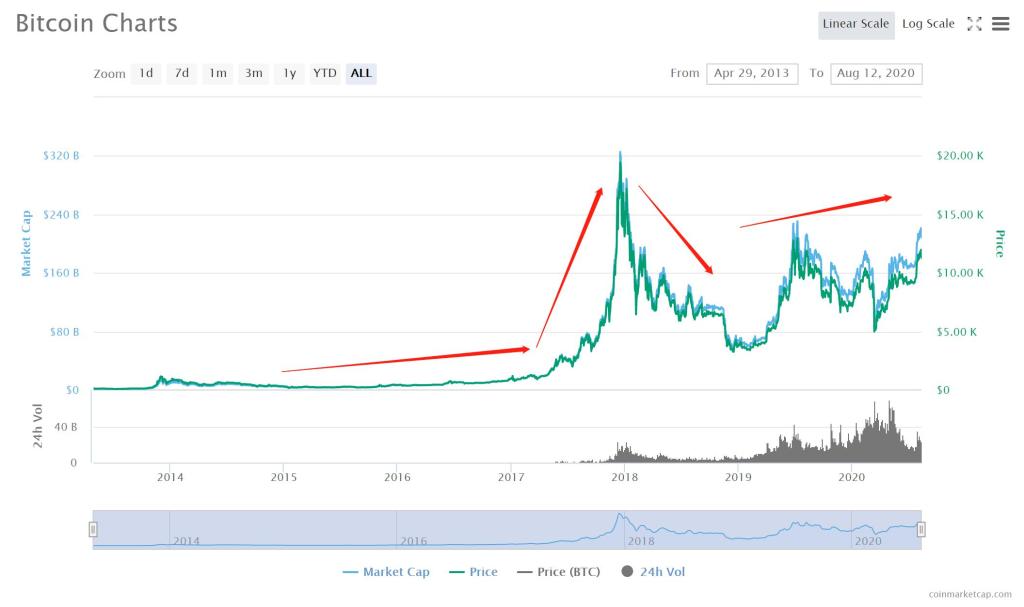

2012-2016 Only first halving happened, supply is high at low price,plus demand is super low as nobody knows BTC, therefore the price stays low

2016-2018 Second halving happened, increasing amount of supply is lower plus demand increase significantly as BTC become well-known, therefore the price goes up to sky

2018-2019 The price goes to a point that is too high that many people are more willing to sell than to keep, the supply of BTC therefore is higher than demand, as fewer people dare to buy at high price. This drives the price down crazily

2019-2020 The negative emotion triggered from the drop is disappearing and price start to bounce back, as people were looking forward to the halving in 2020. However coronavirus makes people panic, and people have much higher priority to buy commodities for daily life and less interested in investing, the demand falls which drives the price down.

The situation now become more complicated but in general I would expect the price goes up later on as the third halving effect on lowering supply, and in general the demand is rising over time(you may refer to 24h Volume in graph below, it indicates the amount of capital involved in BTC transactions)

From the supply and demand relation, we can learn that we should trade like this:

- Find coins with limited supply and on average high demand

- Buy when the market is bear and price is low

- Sell when the market is bull and price rise up

However, the supply and demand effect works better in long term, and it is not the only factor that affect the price. If you want profit quick, you may need to dig into technical analysis to make it happen.